How to Check CIBIL Score in Paytm An important aspect in today’s fast-paced digital age is your credit score, and it is important to monitor it regularly to maintain a strong financial profile. Paytm, a versatile digital platform, not only facilitates transactions but also provides tools to monitor your creditworthiness. In this comprehensive guide, we will explain in detail the intricacies of understanding and checking your CIBIL score through Paytm.

Table of Contents

Understanding the Importance of CIBIL Score

Why does your credit score matter? Credit Information Bureau (India) Limited, commonly known as CIBIL, is a leading credit information company that assesses the credit worthiness of an individual based on his credit history. Your credit score, ranging from 300 to 900, reflects your creditworthiness, and a higher score indicates a better credit profile.

Lenders such as banks and financial institutions refer to your credit score when evaluating your loan or credit card application. A higher credit score increases your chances of approval and may also lead to more favorable interest rates. Therefore, monitoring your CIBIL score regularly is a proactive step towards maintaining a healthy financial life.

Facility to check CIBIL score on Paytm

How to Check CIBIL Score in Paytm, widely known for its user-friendly interface and comprehensive financial services, offers a hassle-free way to check your CIBIL score. The platform has integrated credit score checking services, allowing users to stay updated on their credit health without the need for multiple applications or websites.

Steps to check CIBIL score in Paytm

Now, let’s see the step-by-step process to check your CIBIL score on Paytm:

Open Paytm app

Make sure that you have the latest version of Paytm app installed on your smartphone.

Launch the app and enter your credentials to access your Paytm account.

Go to Credit Score section

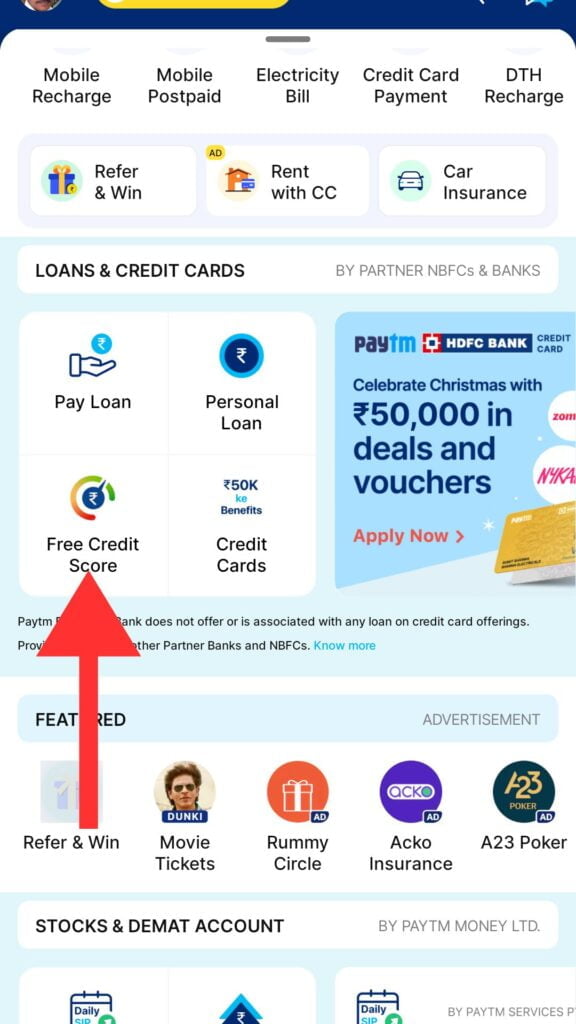

Once logged in, go to the “Money” or “Paytm Money” section depending on the version of the app.

Select Credit Score option

Within the “Money” section, look for options related to credit score. It could be identified as “Check CIBIL Score” or “Credit Score.”

Provide necessary information

To access your credit score, Paytm may request some basic information to verify your identity. This may include details like your full name, date of birth and PAN card number.

Consent for credit information

Before proceeding, you may need to provide consent for Paytm to access your credit information from CIBIL. Verify that you have read and comprehended the terms and conditions.

Check your credit score

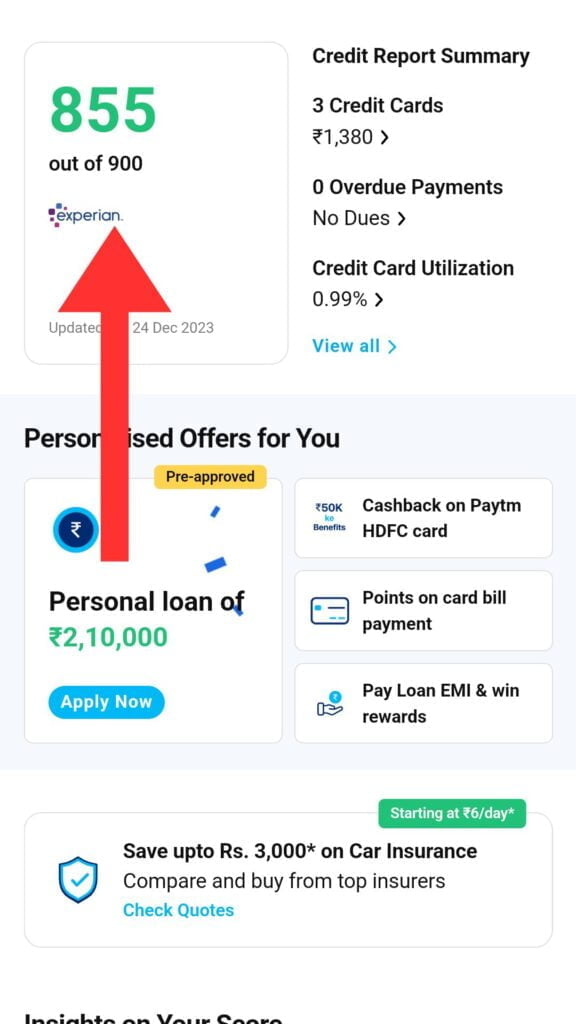

How to Check CIBIL Score in Paytm, Once the required steps are completed, Paytm will display your CIBIL score on the screen. Pay attention to the score and any additional information provided, such as factors affecting your creditworthiness.

Benefits of checking CIBIL score on Paytm

Single platform facility

The integration of Paytm’s credit score services eliminates the need to visit multiple platforms. Users can seamlessly access their credit information within the apps they already use for various financial transactions.

Real time updates

Paytm provides real-time updates on your credit score, so you can stay informed about any changes. This feature is especially beneficial for those who are actively working on improving their credit profile.

Educational Insights

In addition to your credit score, Paytm can provide information about factors that affect your score. Understanding these factors empowers users to make informed financial decisions and work toward improving their credit.

Security measures

How to check cibil score in Paytm adopts strong security measures to protect user information. This ensures that your sensitive financial data, including your credit score, is handled with the utmost confidentiality and security.

Tips to improve your CIBIL score

Payment of bills on time

Make sure you pay your credit card bills and loan EMIs on time. Your credit score is positively impacted by timely payments.

Debt Utilization Ratio

Maintain a healthy credit utilization ratio by not maxing out your credit cards. Aim to use only a portion of your available credit to demonstrate responsible credit management.

Diversify credit mix

A mix of different types of credit, such as credit cards and loans, can have a positive impact on your credit score. However, only take out credit that you can manage responsibly.

Monitor your credit report regularly

Review your credit report periodically for inaccuracies or discrepancies. If you notice any issues, resolve them immediately to avoid any negative effects on your credit score.

conclusion

Ultimately, Paytm serves as a user-friendly gateway to monitor your CIBIL score and, by extension, your overall financial health. Checking your credit score regularly on Paytm gives you the necessary knowledge to make good financial decisions and work towards achieving your financial goals.

Remember, a good credit score is a valuable asset that opens doors to better financial opportunities. By following the steps outlined and incorporating responsible financial habits, you can take control of your credit health and pave the way to a secure financial future.

Frequently Asked Questions (FAQs) – How to Check CIBIL Score in Paytm

- Q: Why should I check my CIBIL score on Paytm?

- Q: Is there any cost to check CIBIL score on Paytm?

- Q: How often should I check my CIBIL score?

- Q: What information do I need to provide to check my CIBIL score on Paytm?

- Q: How long does it take to get my CIBIL score on Paytm?

- Q: Will checking my CIBIL score on Paytm affect my credit score?

- Q: Can I dispute errors on my credit report through Paytm?

- Q: What factors affect my credit score, and can Paytm provide insight?

- Q: Can I improve my credit score through Paytm?

1 thought on “How to Check CIBIL Score in Paytm”