In India, the relationship between Permanent Account Number (PAN) and Aadhaar card has gained prominence due to its importance in various financial transactions. In this blog post, we will guide you through the process to link your PAN card with your Aadhar card online.

Table of Contents

Understanding PAN and Aadhaar

Before considering the steps to link PAN and Aadhaar online, it is necessary to understand the importance of these two identity documents and register mobile no.

1. Permanent Account Number (PAN)

PAN, issued by the Income Tax Department of India, serves as a unique identification number for individuals and entities engaging in financial transactions. It is mandatory for various activities such as filing income tax returns, opening bank accounts and carrying out high value financial transactions.

2. Aadhar card

3. Register Mobile no.

Importance of linking PAN with Aadhaar

Linking PAN with Aadhaar has become mandatory for several reasons, the main objective of which is to increase transparency and curb tax evasion. Some major reasons include:

1. Streamlining Financial Transactions

Linking PAN and Aadhaar helps streamline financial transactions and ensure that individuals are accountable for their income and assets. This engagement facilitates a more efficient and transparent taxation system.

2. Preventing Duplicate PANs

The linkage process helps to identify and eliminate duplicate PANs, reduce the possibility of fraudulent activities and ensure a more accurate database.

3. To meet legal requirements

The government has made it mandatory for individuals to link their PAN with Aadhaar to comply with legal requirements. Failure to do so may result in consequences including deactivation of the PAN card.

Let us now see the step-by-step process How to Link Pan Card with Aadhar Card Online

Step 1: Reach the official Income Tax e-filing website

To start the process, visit the official Income Tax e-filing website https://www.incometax.gov.in/

Step 2: Register or Log in

If you are a new user then you have to register on the portal. If you are an existing user, log in using your credentials.

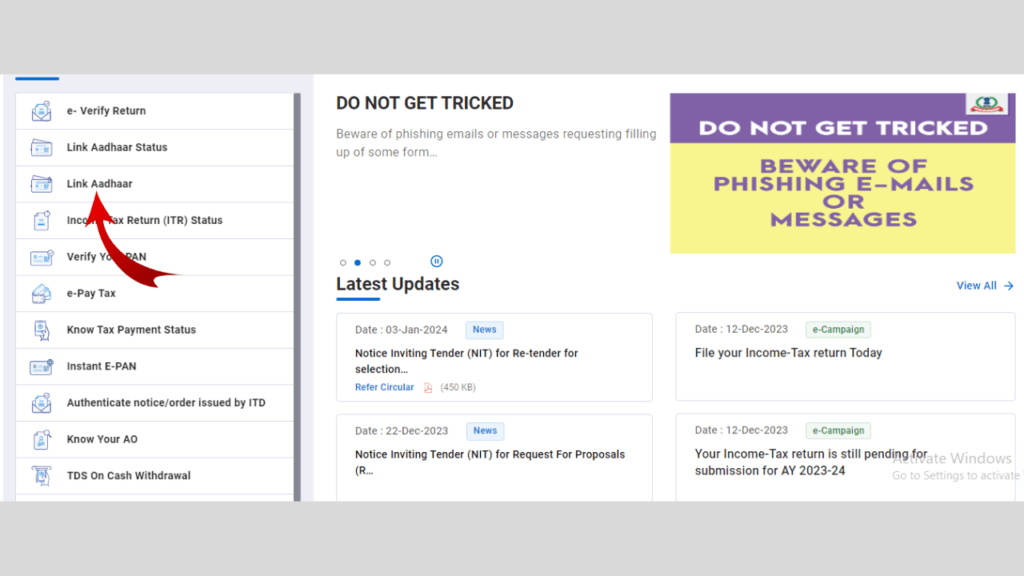

Step 3: Go to 'Link Aadhar'

Navigate to the ‘ Link Aadhar’ tab after logging in. Here you will get the option to Link Aadhar.

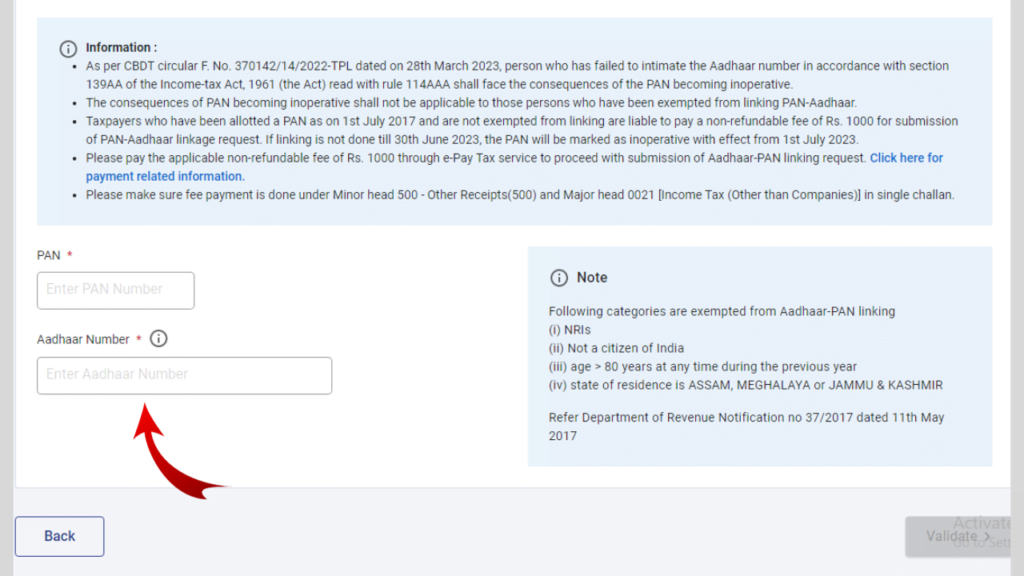

Step 4: Enter Aadhaar and Pan details

Click on ‘Link Aadhaar’ in section. Enter your Aadhaar number and name mentioned on Aadhaar card. Make sure the details match your PAN card.

Step 5: Verify using OTP

After entering the required details, the system will ask you to validate the information using OTP (One-Time Password) sent to the mobile number registered with Aadhaar. Enter OTP to proceed further.

Step 6: Confirmation

Upon successful verification, a confirmation message will be displayed, indicating that your PAN is now linked to Aadhaar.

It is important to note that the linking process is free and can be completed from the comfort of your home or office.

Tips and Ideas

1. Verify Details:

Make sure that the details entered during the linking process match your PAN and Aadhar card. Inconsistencies may result in connection failure.

2. Use registered mobile number:

Make sure that the mobile number registered with Aadhaar is accessible, as OTP will be sent to this number for verification.

3. Keep documents safe:

Keep your PAN and Aadhaar card ready before starting the online linking process. This will help in entering accurate details.

4. Beware of fraudulent websites:

Use only the official Income Tax e-filing website to link PAN with Aadhaar. Be wary of fraudulent websites that may try to misuse your personal information.

conclusion

Linking PAN with Aadhaar is a straightforward process that plays a vital role in ensuring financial transparency and compliance. The online linkage process eliminates the need for physical visits to government offices, making it convenient for individuals. By following the steps mentioned in this blog post, you can successfully link your PAN with Aadhaar online, and most importantly, it is a service provided by the government for free. Stay compliant, stay secure and contribute to a more transparent financial ecosystem

Frequently Asked Questions (FAQs) - Linking PAN Card with Aadhar Card Online

- Why is the PAN-Aadhaar linkage required?

- Linking PAN with Aadhaar is necessary to streamline financial transactions, prevent tax evasion and maintain a transparent taxation system. It is mandated by the government to ensure accountability and accuracy in the financial records of individuals.

- How can I check whether my PAN is already linked to Aadhaar or not?

- You can check PAN-Aadhaar linkage status on the official Income Tax e-filing website. Under ‘Profile Settings’, select ‘Link Aadhaar’ to check the status. Alternatively, you can use the SMS facility provided by UIDAI to check the linkage status.

- Are there any charges for linking PAN with Aadhaar online?

- No, the process of linking PAN with Aadhaar online is completely free. Individuals can do this from the official Income Tax e-filing website without any charges.

- Can I link multiple PANs with the same Aadhaar?

- No, linking multiple PANs with the same Aadhaar is not acceptable. Each individual must link his/her unique PAN with his/her respective Aadhaar to maintain accuracy and prevent fraudulent activities.

- What should I do if there are discrepancies in my PAN or Aadhaar details?

- Make sure that the details entered during the linking process match your PAN and Aadhar card. In case of discrepancies, update the details on the PAN or Aadhaar database before attempting to link again.

- I do not have an account on the Income Tax e-filing website. How can I register?

- To register on the Income Tax e-filing website, visit the official portal and select the ‘Register Yourself’ option. Follow the registration process by providing the required details and create a user account.

- What if I do not link my PAN with Aadhaar?

- Failure to link PAN with Aadhaar may have consequences, including deactivation of the PAN card. This is a legal requirement, and non-compliance may lead to difficulties in financial transactions and other government-related services.

- Can I link PAN to Aadhaar offline?

- While the online method is more convenient, individuals can also link PAN with Aadhaar offline by visiting the PAN service centers of NSDL or UTITSL. However, the online process is recommended due to its simplicity and accessibility.

- Is it safe to enter your Aadhaar details online for linkage?

- Yes, the official Income Tax e-filing website ensures a secure platform to link PAN with Aadhaar. Always use the official website to avoid falling victim to fraudulent activities on unauthorized platforms.

- What if my mobile number is not linked to Aadhaar?

- It is important for the mobile number registered with Aadhaar to be accessible, as an OTP will be sent for verification during the linking process. If your mobile number is not linked, update it through the official UIDAI website before proceeding.